Checking Accounts

We offer a deposit product to meet your needs.

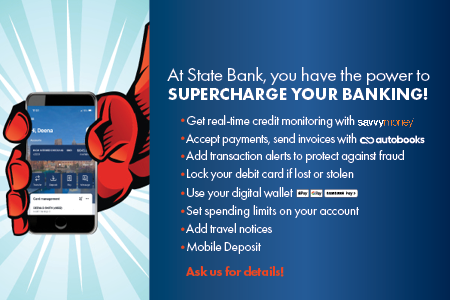

State Bank offers the convenience and technology that today’s consumer is looking for. And you receive the extra advantage of banking where your business is truly appreciated!

State Bank offers the convenience and technology that today’s consumer is looking for. And you receive the extra advantage of banking where your business is truly appreciated!

Included with all of our checking accounts:

- State of the art Online Banking and BillPay to keep you on top of your money 24/7

- Easy to use Mobile app for access to your bank from anywhere

- Mobile Remote Deposit makes depositing checks simple-no trip to the bank needed!

- Purchases using your account made easy with our VISA Debit Card – CLICK HERE for Debit Card Management

- Unlimited State Bank and Allpoint ATM Transactions

- Free direct deposit for your paycheck, Social Security check, or other regular income.

If you’re with another institution, switch your accounts to State Bank anytime from anywhere. It’s quick and easy with our Switch Kit. If you would like more information, and would like to open an account in person, just stop by one of our convenient locations.

To help you keep all of your banking in one convenient location, State Bank offers various checking accounts to meet your needs. Our accounts are customized to meet the varying needs of our unique customers, and with every account, you will find online banking and bill-pay, an easy-to-use mobile app, free direct deposits, and unlimited State Bank and Allpoint ATM transactions.

Apply for a New Checking Account Today!

When looking for a new checking account, State Bank makes the process easy. As the premier and trusted bank in central Indiana for over 100 years, we offer the banking tools you need to live your life and take control of your finances with ease. Whether your choose to open your account online below or visit your local banking center, we stand ready to help you with all of your financial needs. Have further questions? Call us at 866-348-4674 today!

High Interest Checking

Put your money to work and earn a higher interest rate on your qualified account balance.

- 1.00% APY* interest on balance up to $15,000 with 15 debit card purchases per cycle

- First order of State Bank checks free

- $15 monthly fee waived with a $5,000 daily balance

- $50 opening deposit

- Enroll in eStatements to avoid a $5 monthly paper statement fee (fee waived ages 65+)

Cash Back Rewards Checking

Get rewarded when you make your purchases!

- 1.00% cash back for debit card transactions up to $7.00 with a minimum of 7 transactions per cycle

- $7 monthly fee waived with one direct deposit per cycle and a $700 daily balance

- $50 opening deposit

- Enroll in eStatements to avoid a $5 monthly paper statement fee (fee waived ages 65+)

Simply Free Checking

No minimums, no requirements. Simply Free!

- No minimum balance and no monthly fee

- $50 opening deposit

- Enroll in eStatements to avoid a $5 monthly paper statement fee

*Annual Percentage Yield (APY) valid as of 1/18/2023. The rate may change after the account is opened. The APY for your account depends on the applicable rate tier which may change at our discretion. If qualifications are not met, APY of 0.01% applied. Must maintain a minimum balance of $0.01 to obtain the disclosed APY. Fees may reduce earnings.